How Financial Planner Businesses Capture More of the Demand Already in Their Market

Demand for financial planning exists. Individuals search for financial advisors, compare credentials, and schedule consultations with whoever responds first.

The difference between a full client roster and empty calendar slots is not planning expertise. It is capture infrastructure. Most financial planners lose half their demand to missed calls, slow follow-up, and invisible moments when prospects are ready to engage.

Growth in this field comes from visibility during high-intent searches, immediate response to consultations, and systematic follow-up. The planners that capture more demand are not advertising more—they have better infrastructure.

Common Demand Leaks for Financial Planners

Missed calls during client meetings

Prospects call while you are meeting with other clients. Voicemail reduces new client acquisition by 65%.

After-hours research inquiries

Professionals research financial planners in the evening after work. Planners without immediate response lose these prospects.

Poor visibility for service-specific searches

Prospects search for retirement planning, investment advisors, estate planning. Generic listings lose these targeted searches.

Slow consultation scheduling

A prospect requesting a consultation will engage with whoever schedules it within 24 hours. Delays lose most opportunities.

No clarity on fee structure

Prospects need to understand if you are fee-only, commission-based, or AUM-based. Unclear messaging results in lost clients.

Weak referral follow-up

Client referrals that are not contacted immediately often engage with other planners.

Buying Moments for Financial Planner

Buying Moments for financial planners are situations where a prospect has decided to engage a planner and is comparing options:

Life transition

Someone experiencing a major life event—inheritance, job change, divorce—searches for financial guidance. They will schedule consultations with 2-3 planners.

Retirement planning urgency

A professional 5-10 years from retirement realizes they need a plan. This is a high-value, long-term client relationship.

Investment performance concern

Someone unhappy with their current advisor or DIY investing searches for professional help. This is a ready-to-switch prospect.

Tax planning need

A high-earner facing tax consequences searches for financial and tax planning expertise. These are high-value clients.

How the System Captures Demand

The system captures financial planning demand through four layers:

Visibility

Ads placed for high-intent searches: "financial advisor near me", "retirement planning [city]", "fee-only financial planner". Listings optimized for service-specific and credential-based queries. Your practice appears when prospects are actively searching.

Capture

Calls answered immediately, even during client meetings. Consultation requests responded to within minutes. Every inquiry is captured, not lost to voicemail.

Conversion

AI answering system schedules consultations directly. Follow-up sequences for prospects who inquired but did not engage. Buying Moments are converted into client relationships.

Protection

Continuous monitoring of coverage, leak detection, and competitor activity. Monthly reviews show where demand is captured and where it is being lost. System improves based on real client acquisition data.

What You See

What you see with this system:

- •Which searches your practice appears for and which you do not cover

- •How many calls were answered versus missed

- •Where website visitors come from and what they searched for

- •Which inquiries converted to clients and which did not

- •What is being improved next and why

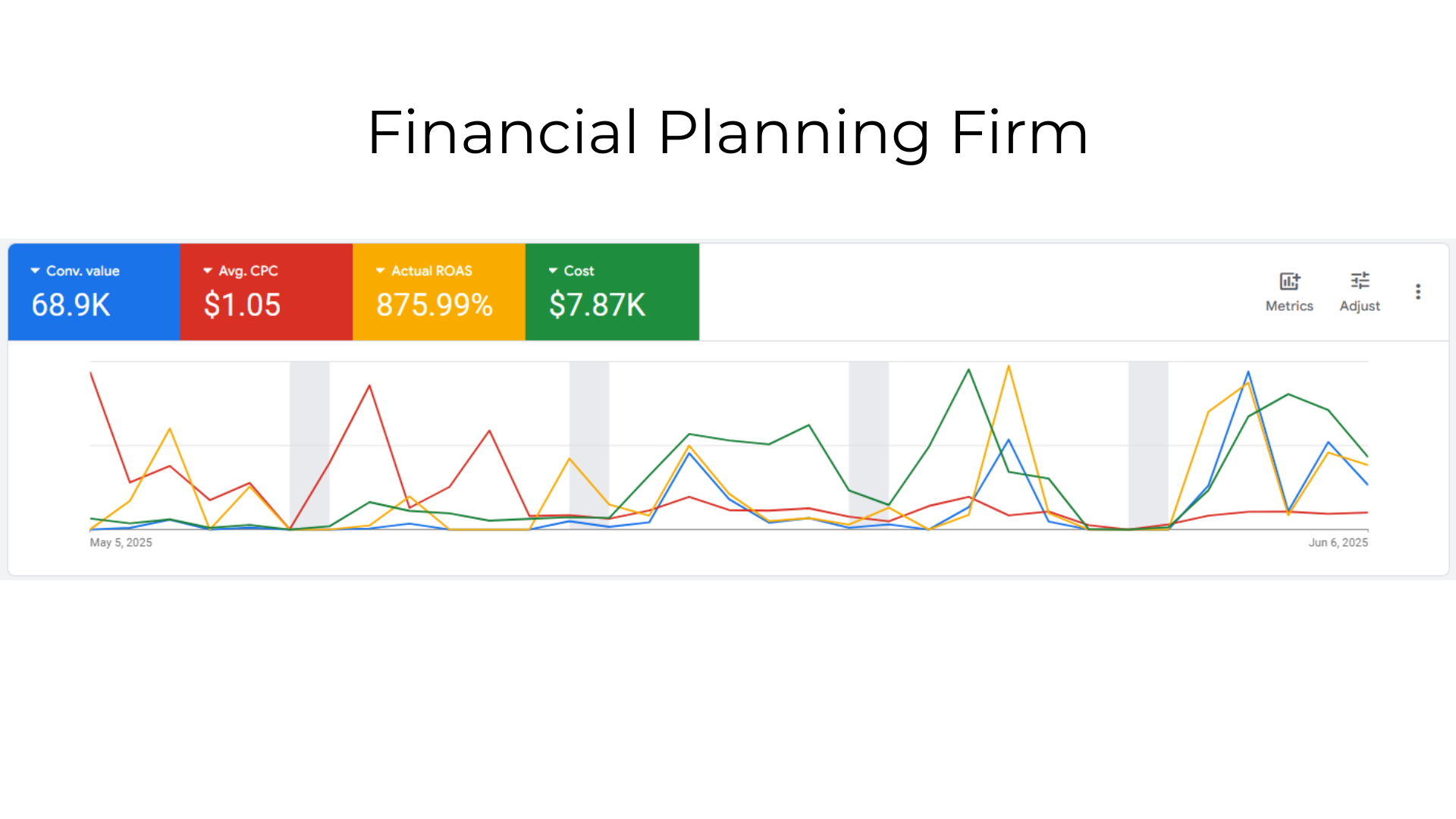

Real Results for Financial Planner

Performance Summary

"Pivoted from display to high-intent search and YouTube remarketing."

Results are specific to this business and market. Your results will vary based on your industry, competition, and implementation quality.

Important Notes

Key Metrics Breakdown

System Deployments

System deployments for financial planners have shown:

A financial planning firm captured $68.9K in conversion value by pivoting from display to high-intent search and YouTube remarketing.

Service-specific campaigns targeting retirement planning and investment management increased consultation bookings.

Immediate consultation scheduling converted prospects who were comparing multiple advisors.

These examples reflect what occurred in specific situations for specific businesses. They are not guarantees, projections, or promises of results. Max Digital Edge guarantees system visibility and coverage accountability—not specific performance outcomes.

Who This Is For

Good fit

- •Financial planners with capacity for new clients but inconsistent lead flow

- •Practices losing prospects to advisors who schedule consultations faster

- •Planners wanting visibility into where demand is coming from and where it is leaking

Not a fit

- •Planners expecting guaranteed clients without responsive follow-up

- •Practices unwilling to schedule consultations or answer inquiries promptly

- •Planners looking for marketing hype instead of systematic infrastructure

Common Questions

How we help Financial Planner capture demand

Demand for financial planning exists right now in your market. Prospects are searching for retirement planning, IRA rollovers, and fiduciary advisors. You lose opportunities when coverage gaps prevent visibility during these high-intent searches, or when conversion leakage lets competitors capture demand you paid to generate.

Fix Google Ads

Stop wasted spend on broad financial keywords and restore tracking for retirement planning and fiduciary searches.

Learn moreBuying Moment Coverage™

Own visibility across retirement questions, rollover decisions, and advisor comparison moments.

Learn moreAI Answering & Booking

Protect speed-to-lead for initial consultations and advisor comparison inquiries.

Learn moreBuying-Moment Landing Pages

Convert financial planning searches with pages built for retirement planning and fiduciary selection.

Learn morePricing

See setup and monthly costs for the demand capture system built for financial planning firms.

Learn moreContact

Request a coverage review to identify where financial planning demand is leaking in your market.

Learn moreService Coverage

Financial Planner Businesses Across the United States

Max Digital Edge builds demand capture infrastructure for Financial Planner businesses in every major US market. Select your city to see market-specific demand capture insights.

Request a Coverage Review

See where your demand is leaking. Coverage starts immediately.

Request Coverage Review